Deficit Spending

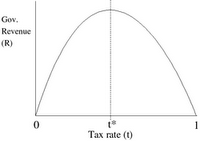

There is a correlation between the tax rate and the revenue generated. If a tax rate is too high or too low, then the government does not maximize the tax revenue it could achieve. This theory is called the Laffer Curve, which has previously been discussed. The same kind of principal applies to the amount of tax received and the amount of spending in which the government engages.

There is a correlation between the tax rate and the revenue generated. If a tax rate is too high or too low, then the government does not maximize the tax revenue it could achieve. This theory is called the Laffer Curve, which has previously been discussed. The same kind of principal applies to the amount of tax received and the amount of spending in which the government engages.

If the government receives too little revenue, it spends more than it receives. If it receives too much money through tax revenue, then it spends too much. The end result in either case is deficit spending. There is, however, a solution. If the tax rate is too low, as it currently is, the tax rate needs to be increased to prevent overspending. If the tax rate is too high, the tax rate would need to be decreased to prevent overspending. Apparently, the ideal tax rate to prevent deficit spending is 19%.**

The rationale for the required tax rate is that Congress and the public need to feel the pinch of government. If the perceived cost of government is that it is cheap, then overspending results. In more micro terms, if a person has a high credit limit and low monthly payment, then it does not seem to cost a lot to spend a lot so debt is incurred. If the cost of high spending is perceived to be expensive (a higher monthly credit card payment), then it is less likely that a person or Congress will over spend. If the spending curve was graphically superimposed on the Laffer Curve, it would show an increase in spending by .15% for every 1% of tax rate reduction and a decrease in spending of .15% for every 1% of tax increase.

Many said that the balanced budgets during the Clinton Administration were a result of the GOP Congress being so disciplined. Considering the deficit spending that the GOP has engaged in while controlling the Congress and White House, this is obviously not the case. Rather, it was the tax increases that the first Bush and Clinton Administrations imposed that controlled spending. The reason for today's deficit spending is the ill conceived tax cuts that were given to the wealthy in 2001 and 2003 because now the cost of government seems low so it is easy for Congress to continue to spend too much money. Had these cuts not gone into place, the perceived cost of government would have remained high and the spending would have remained under control, and the debt imposed upon the future generations would not have been imposed.

To prevent future generations from being saddled with continued debt, this new Democratic Congress needs to raise taxes to maximize revenue and eliminate deficit spending. Taxes need to be raised and the debts which have accumulated over these past six years need to be paid immediately so that the American Public is not saddled with the significant debt and high tax rates that will be necessary in the future to correct the fiscal mismanagement done by the Bush Administration.

* The diagram is from Wikipedia

** More information on this can be obtained in the June 2006 Atlantic Monthly; however, a subscription to the website is required.

No comments:

Post a Comment